Though it makes sense that future business school candidates would have their eyes on the monetary profitability of their investment, the survey data show there were other nonfinancial criteria that also factored highly in alumni decisions to invest in a graduate management education. Business school recruitment, marketing, and admissions professionals who can effectively communicate these nonfinancial returns on a degree from their institution will likely have more success converting inquiring candidates to applicants.

The “3D” Business School Value Proposition

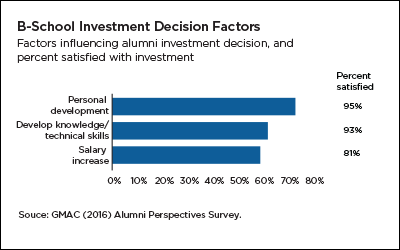

There are three key factors that a majority of alumni considered when applying to graduate business school: opportunity for personal development (considered by 73% of alumni), expansion of knowledge and skills (62%), and salary increase (59%). Among alumni who cited these specific investment decision factors, the vast majority report high levels of satisfaction with their investment decision.

These findings underscore that salary and financial ROI are just one factor that drives business school candidates to pursue a graduate management education. Just as important—if not more important—are personal development and skill development outcomes. The data suggest that along these metrics, more than 9 in 10 alumni are satisfied with the investment of their tuition, time, and energy. In positioning their programs to potential applicants, business school recruiters and marketers may be well served to discuss the outcomes of their programs in these terms.

Money Matters

The data suggest that the financial return was not the overall top investment decision factor for alumni, but, money does matter. According to the 2016 mba.com Prospective Students Survey, the most common reservations prospective students have about pursuing a graduate management education are related to cost:

- Fifty-one percent say they are concerned that a graduate management education will require more money than they have available.

- Forty-six percent are worried that it will require them to take on a large debt load.

Even though the starting salaries of business school alumni have risen steadily over the past two decades, the average total investment cost of earning a graduate business degree has risen at a faster pace. Even so, alumni ROI is still positive, and from an earnings perspective alumni tend to outperform those who do not pursue a graduate-level education. Attracting prospective students therefore requires business schools to present the financial proposition. But highlighting the nonmonetary gains that continued education delivers to successful graduates is a winning communications strategy in both good and bad economic times.

For more information on graduate business school alumni ROI, in addition to detailed data on career progression and skills required in the workforce, download the 2016 Alumni Perspectives Survey Report at gmac.com/alumniperspectives.